Table of Contents

1. INTRODUCTION: WHY TESLA IS NO LONGER JUST A CAR COMPANY

When Elon Musk claimed that humanoid robots could one day make up 80% of Tesla’s value, it marked a turning point in how the world sees the company. Tesla is no longer just an electric vehicle maker, it’s becoming a pioneer in artificial intelligence and robotics. The Tesla AI and Robotics future with Optimus humanoid robot sits at the center of this shift. a car company, an energy company, a software company, and an artificial intelligence (AI) and robotics company Designed to handle repetitive or unsafe tasks, Optimus represents Musk’s boldest bet yet, signaling a future where Tesla’s identity will be defined more by machines that walk than cars that drive.

The company that disrupted the auto industry with sleek electric vehicles is now pivoting toward something bigger: Tesla AI and Robotics. At the center of this pivot is Optimus, a humanoid robot designed to do the kinds of jobs most humans would rather avoid, repetitive, unsafe, and dull work.

Why this shift now? Partly because Tesla’s EV sales are slowing. Deliveries have fallen sharply in Europe and dipped in China, competition from BYD(Build Your Dreams,” is a Chinese multinational Conglomerate) and others is mounting, and consumer demand is cooling as subsidies expire. At the same time, Tesla has poured years into developing its AI systems for Full Self-Driving (FSD). Repurposing that technology into robotics isn’t just logical—it’s existential.

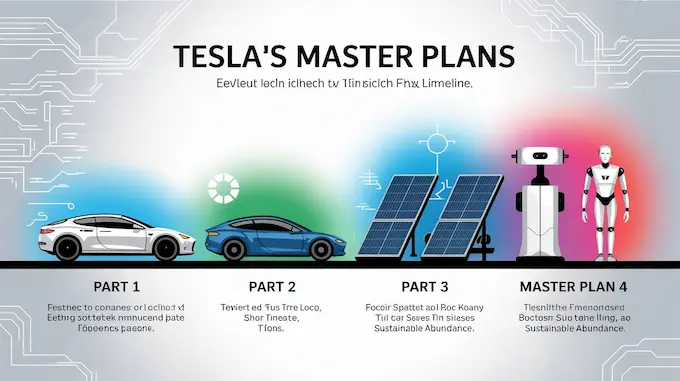

Tesla Master Plan Part 4 makes it official. Tesla’s future is being redefined around AI, humanoid robots, and a vision Musk calls “sustainable abundance.”

2. TESLA MASTER PLAN PART 4: A BLUEPRINT FOR “SUSTAINABLE ABUNDANCE”

2.1 A PIVOT FROM CARS TO ROBOTS

The first three master plans were linear. Build a halo EV. Scale to affordable cars. Add clean energy. Push autonomy.

Part 4 breaks the mold. Instead of focusing on mobility, it reframes Tesla’s role entirely. Musk’s vision is that by scaling AI and robotics, society could achieve a state where energy and labor costs fall so low that most of the world’s productivity constraints disappear.

This is what he calls sustainable abundance. The phrase is not just aspirational marketing. It reflects a conviction that AI and robots, deployed at scale, can reshape the very foundations of the economy.

2.2 SOLVING MACRO PROBLEMS

Musk has even linked humanoid robots to addressing national debt. The logic is simple, if controversial. If you can flood industries with ultra-low-cost, ultra-efficient robotic labor, GDP rises dramatically while costs drop. That surplus, in theory, could help nations tackle debt loads that look insurmountable today.

Ambitious? Absolutely. But that ambition is what makes Tesla Master Plan Part 4 stand apart.

3. MEET TESLA OPTIMUS: THE HUMANOID ROBOT AT THE CENTER OF THE PIVOT

3.1 DESIGN AND PURPOSE

Optimus isn’t just a tech demo. Tesla envisions it as a general-purpose worker. About human height and weight, with 26 actuators per arm and hands designed for dexterity, Optimus is intended to fit seamlessly into environments built for people.

That makes it more versatile than traditional industrial robots, which are bolted to the floor, limited to repetitive tasks, and isolated from humans. Optimus, in theory, could walk around a warehouse, carry boxes, assemble parts, or even help in households.

Hands are the hardest part. Human dexterity is the gold standard in robotics, and no company has cracked it at scale. Tesla is betting that its AI-driven approach will allow Optimus to learn and adapt better than rule based competitors.

3.2 THE ECONOMICS OF ROBOTICS

Tesla’s production roadmap for Optimus is breathtaking in its ambition:

- 2025: Several thousand units.

- 2026: 50,000 to 100,000 units.

- 2030: Half a million to one million units annually.

The target cost is $20,000–$30,000 per robot. At that price, Optimus would undercut advanced competitors like Boston Dynamics’ Atlas, which costs millions and is not for sale. If Tesla pulls this off, analysts estimate the humanoid robot market could top $200 billion by the decade’s end and trillions by mid-century.

Musk calls Optimus “the largest product opportunity in history.” For context, he’s suggesting that robots could be bigger than cars, bigger than smartphones, bigger than any single product line in modern industrial history.

4. THE ROLE OF FULL SELF-DRIVING (FSD) IN TESLA’S ROBOTICS AMBITION

4.1 HOW FSD TRANSLATES INTO ROBOTS

Tesla’s competitive edge in robotics comes from an unlikely place: cars.

Full Self-Driving (FSD), trained on billions of miles of real-world driving data, has forced Tesla to solve some of the hardest problems in AI perception, planning, and control in chaotic, unpredictable environments.

These same capabilities are required for humanoid robots. Optimus needs to see, understand, and act in the real world. Whether that’s avoiding obstacles in a factory or picking up fragile objects, the core AI challenge is similar to driving.

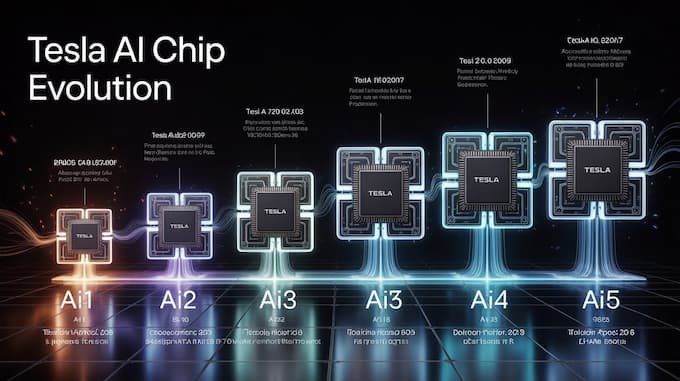

4.2 THE AI HARDWARE LEAP

Tesla also designs its own hardware. The shift from the AI4 chip to AI5 represents a massive leap:

- 8x more compute power

- 10x memory capacity

- 5x memory bandwidth

- Up to 40x performance gains in some workloads

For cars, this means FSD can run larger models with faster reaction times. For robots, it means the brains are finally powerful enough to handle bipedal locomotion, fine motor control, and on device learning.

This vertical integration,Tesla designing both the AI stack and the hardware it runs on sets it apart from most robotics companies, which rely on third-party silicon and external suppliers.

5. TESLA AI AND ROBOTICS VS COMPETITORS

Tesla isn’t alone in chasing humanoid robotics. Honda’s Asimo, Boston Dynamics’ Atlas, and Agility Robotics’ Digit are often cited as competitors. But Tesla’s approach differs in key ways:

- Mass Production First: Most humanoid robots are research projects. Tesla is aiming for millions of units.

- AI-First Design: Tesla builds from an AI foundation, not mechanical engineering alone.

- Economics: A $20,000 robot would be disruptive. Competitors are priced in the hundreds of thousands or millions.

- Capital and Data: Tesla’s market cap and data advantage from its vehicle fleet dwarf most robotics startups.

That said, competitors like Boston Dynamics still lead in agility and locomotion. Tesla’s challenge is to catch up mechanically while leveraging its AI and manufacturing advantage.

6. CHALLENGES: WHERE THE OPTIMUS DREAM COLLIDES WITH REALITY

6.1 TECHNICAL HEADWINDS

By mid-2025, Tesla had built around a thousand Optimus prototypes. Production had to be paused due to overheating, weak batteries, and low payload capacity. Gen 3 redesigns focused heavily on the hands and arms areas where precision and durability are essential.

These problems underscore the gap between flashy stage demos and industrial reliability. Building one robot is difficult. Building a million identical, reliable robots is orders of magnitude harder.

6.2 THE CREDIBILITY GAP

Tesla also faces a credibility issue. The company has a history of overpromising. Robotaxis, solar roofs, and early FSD timelines are all reminders. Critics argue that humanoid robots may be another long-term project dressed up as near-term reality.

For investors, the risk is obvious. If EV sales keep slowing while robots remain delayed, Tesla’s financial cushion may shrink faster than its robotics bets can pay off.

7. SLOWING EV SALES AND THE FINANCIAL STAKES OF ROBOTICS

Tesla’s pivot toward AI and robotics doesn’t exist in a vacuum. It comes at a moment when the EV business, once Tesla’s growth rocket, is hitting turbulence.

In the first half of 2025, global deliveries dropped 13%, with a nearly 40% collapse in Europe and a 5% decline in China. The culprits include rising competition from BYD and other Chinese automakers, waning consumer subsidies, and a broader cooling of the EV hype cycle.

Tesla’s revenue slipped to $22.5 billion, down 12% year-over-year, and the stock fell about 17–20% year-to-date. For a company accustomed to breakneck growth, these numbers were sobering.

This is why Optimus matters. Robots aren’t just Musk’s passion project, they’re Tesla’s hedge against slowing EV sales. If Optimus can move from prototype to scale, it gives Tesla a fresh revenue engine at precisely the time its core market is maturing.

8. INVESTOR OUTLOOK: CAN TESLA DELIVER OR OVERPROMISE AGAIN?

Wall Street is divided.

On one side are the visionaries. They argue that Tesla is uniquely positioned to dominate humanoid robotics. The combination of FSD AI, in-house hardware, and capital reserves could allow Tesla to do what Boston Dynamics and Honda couldn’t: commercialize humanoid robots at scale.

On the other side are the skeptics. They point to a familiar pattern: bold announcements, delayed timelines, and products that take years longer than promised. Robotaxis, still not fully realized, serve as Exhibit A.

The market response reflects this split. Tesla’s stock dipped on weak EV sales but began climbing again after the unveiling of Master Plan Part 4. Investors, for now, are willing to bet that the future of Tesla AI and Robotics could outweigh near-term struggles.

But patience is finite. If 2025–2026 pass without external sales of Optimus, skepticism will grow louder.

9. OPPORTUNITIES AND RISKS OF TESLA AI AND ROBOTICS

9.1 OPPORTUNITIES

- A Trillion-Dollar Market: Analysts believe humanoid robots could represent a multi-trillion-dollar market by 2050, covering industries from logistics to elder care. Tesla is angling to be the Apple of this space.

- Productivity Revolution: If robots perform tasks cheaper and safer than humans, companies everywhere will line up to adopt them.

- Tesla’s Moat: Unlike most robotics startups, Tesla already has global manufacturing scale, a proven AI pipeline, and access to one of the largest datasets in history via its vehicles.

- Consumer Robots: Beyond factories, Optimus could enter households, much like smartphones leapt from business to personal use.

9.2 RISKS

- Engineering Complexity: Building one prototype is hard. Building a million reliable robots is exponentially harder.

- Financial Pressure: With slowing EV sales, Tesla needs robotics to succeed faster than its usual timeline tolerance.

- Safety and Trust: A humanoid robot working alongside people raises huge safety and regulatory concerns. A single high-profile accident could stall adoption.

- Overpromising: Tesla’s credibility gap is real. Investors and regulators won’t tolerate endless delays.

10. SUSTAINABILITY: HOW ROBOTICS TIES BACK TO TESLA’S MISSION

Despite the pivot, Tesla hasn’t abandoned sustainability. In 2024 alone, its EV fleet avoided over 20 million metric tons of CO₂ emissions. Energy storage deployments hit a record 14 GWh, enabling renewable integration across global grids. Gigafactories are increasingly powered by 100% renewable energy.

Musk argues that Optimus isn’t separate from this mission. By taking over repetitive tasks, robots could help build green infrastructure faster, streamline renewable projects, and reduce industrial waste. In his view, Tesla AI and Robotics is an extension of Tesla’s original mission, not a departure from it.

This alignment is strategic. It allows Tesla to tell a coherent story to both investors and regulators: cars, energy, and robots are all part of a single sustainability narrative.

11.AI, Robotics, and Optimus Are Redefining Tesla’s Future

Tesla’s future as a robotics company hinges on a few critical milestones:

- Factory Deployment: Large scale use of Optimus in Tesla’s own Gigafactories. This will be the first real proof of commercial viability.

- Technical Breakthroughs: Longer battery life, stronger joints, and reliable dexterity. Without these, Optimus will remain a stage prop.

- External Sales: Delivering robots to customers outside Tesla by 2026. This is the milestone investors care most about.

- EV Stabilization: Even as robots ramp, Tesla must keep its EV business healthy. Without stable vehicle cash flow, funding robotics R&D will be difficult.

Each of these milestones will determine whether Tesla is truly pivoting into robotics or merely experimenting.

| Milestone | Details | Timeline |

|---|---|---|

| Factory Deployment | Large-scale use of Optimus robots inside Tesla’s Gigafactories as proof of commercial viability. | 2025 |

| Technical Breakthroughs | Improvements in battery life, joint durability, and dexterity needed for industrial reliability. | 2025–2026 |

| External Sales | First Optimus units delivered to customers outside Tesla, validating commercial rollout. | Target: 2026 |

| EV Stabilization | Maintaining a healthy vehicle business to finance robotics R&D and sustain growth. | Ongoing |

12. CLOSING: THE FUTURE OF TESLA BEYOND CARS

Tesla’s Master Plan Part 4 is more than a roadmap, it’s a reinvention. Cars are no longer the center of the story. Tesla AI and Robotics, anchored by the Optimus humanoid robot, is the company’s next moonshot.

If Tesla succeeds, it won’t just reshape its own valuation. It could redefine the relationship between humans and machines, ushering in an era where robots become as common in workplaces and homes as cars are on roads today.

If Tesla fails, Optimus may join the long list of overhyped tech dreams. But that’s the essence of moonshots—they either transform the world or teach us why the world wasn’t ready yet.

For now, the bet is clear. Tesla is reaching beyond cars, staking its future on AI and robotics. Whether history records that gamble as genius or hubris will be one of the defining business stories of this century.

Call to Action:

If you follow technology, pay close attention to Tesla’s next two years. The company isn’t just shaping the future of transport anymore. It’s shaping the future of work itself.

Q1. How much will the Tesla Optimus robot cost?

Q1. How much will the Tesla Optimus robot cost?

Tesla has projected a price range of $20,000 to $30,000 per unit once production reaches scale. This is dramatically lower than current humanoid robots, which cost hundreds of thousands or even millions

Q2. Is the Tesla Optimus robot replacing cars as the company’s focus?

Not immediately. Cars and energy still account for nearly all Tesla’s revenue. But Elon Musk has said Optimus could eventually represent 80% of Tesla’s value, signaling a long-term shift in focus.

Q3. What challenges is Tesla facing with the Optimus robot?

The main hurdles include battery life, overheating, payload capacity, and dexterous hand design. Production of Gen-2 units was paused in 2025 for redesigns to address these issues.

Q4. How does Tesla’s FSD technology help its robotics development?

Full Self-Driving (FSD) gave Tesla a decade of experience in AI perception, planning, and decision-making. These same capabilities are essential for robots navigating the physical world.

Q5. When will the Tesla Optimus robot be available?

Tesla plans to build several thousand Optimus units in 2025, ramping to tens of thousands in 2026. External sales could begin as early as 2026, though mass adoption will likely take longer.

Q6. What is Tesla AI and Robotics future with Optimus humanoid robot?

The Tesla AI and Robotics future with Optimus humanoid robot represents the company’s bold pivot beyond cars. By combining its Full Self-Driving AI with advanced hardware, Tesla aims to mass-produce a versatile humanoid robot that can handle unsafe, repetitive, and everyday tasks. Optimus is designed to cut labor costs, boost productivity, and open new trillion-dollar markets, making it central to Elon Musk’s vision of Tesla’s long-term growth.